New federal tax credit and benefits offer boost to combined heat and power (CHP) investment

With the extension of a previously expired investment tax credit and other provisions of the new tax law, CHP will be more attractive to end-users and may drive utilities to develop CHP as a supply resource. Meegan Kelly (ICF) and Levi Hoiriis (Sterling Energy Group) explain.

An extension passed by Congress in the Bipartisan Budget Act of 2018 put the 10% investment tax credit (ITC) back in play for combined heat and power (CHP) technologies, leading developers, end-users, and utilities to take a closer look at the improved economics of CHP developments. Going forward, projects can utilize the tax credit for CHP projects that begin construction by the end of 2021. The maximum project size is 50 MW and the incentive is limited to a project’s first 15 MW.

While important, the ITC is not the only new factor enhancing the CHP market. Key provisions of the new tax law, including bonus depreciation that allows 100% write-off of capital investments in the first year, and the lower 21% corporate tax rate, all help boost after-tax internal rates of return (IRR) for CHP investments. When you combine these benefits with the growing recognition of the value of resilience, low and stable natural gas prices, and continued increases in base electric rates, the business case for CHP has never looked better.

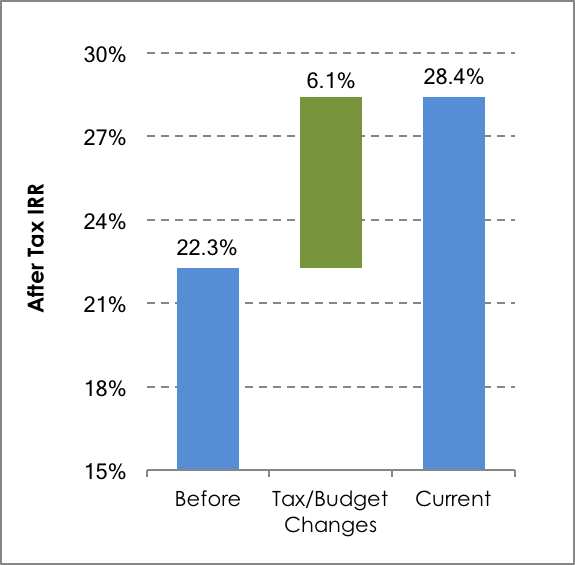

How big is the tax-related boost? It’s not a gold mine, but it offers a significant benefit to a typical CHP project. The following investment cash flow summary offers a high-level overview of the impact of the recent tax changes. This example is based upon a project development summary of a 15 MW CHP located in the Southeast requiring a $23.1MM investment.

The unleveraged after tax IRR before the new tax changes is just over 22%. After the new tax provisions, the after tax IRR increases to approximately 28.5%, reflecting a $900,000 per year increase in levelized annual cash flow. The new provisions push the NPV of the project after tax cash flow benefit from $61.1MM up to $72.4MM, an amount equal to almost half the total project investment.

Table 1: Financial Summary of 15MW CHP Project

|

Before Tax Changes |

With Tax Changes |

||||||||

|

NPV |

Levelized |

Yr1 |

Yr5 |

NPV |

Levelized |

Yr1 |

Yr5 |

||

|

EBITDA |

$87,565K |

$7,026K |

$5,855K |

$6,808K |

$87,565K |

$7,026K |

$5,855K |

$6,808K |

|

|

Book Depreciation |

($9,606K) |

($771K) |

($771K) |

($771K) |

($9,126K) |

($732K) |

($732K) |

($732K) |

|

|

Taxes |

($30,579K) |

($2,454K) |

($1,994K) |

($2,368K) |

($18,298K) |

($1,468K) |

$974K |

($1,588K) |

|

|

Net Income |

$47,379K |

$3,802K |

$3,090K |

$3,669K |

$60,141K |

$4,826K |

$6,096K |

$4,488K |

|

|

Book Depreciation |

$9,606K |

$771K |

$771K |

$771K |

$9,126K |

$732K |

$732K |

$732K |

|

|

Deferred Tax Liability |

$4,165K |

$334K |

$1,512K |

$743K |

$3,083K |

$247K |

$5,550K |

($191K) |

|

|

Cash Flow |

$61,151K |

$4,907K |

$5,372K |

$5,183K |

$72,350K |

$5,806K |

$12,379K |

$5,029K |

|

|

After Tax IRR |

22.3% |

28.4% |

|||||||

Notes: NPV and leveled calculations are 20-year term; all cases use 6.5% state tax rate. Source: Sterling Energy Group, LLC

From a utility perspective, these new tax provisions will make CHP a more attractive option to large customers, which may contribute to the loss of load and revenue if key customers self-generate. However, in recent years, several utility companies have developed CHP strategies, recognizing that collaborating with key customers can be better than competing with them. For example, utility-owned CHP can be a least cost, baseload resource for providing electricity to the grid, while delivering low-cost, more reliable thermal energy onsite to the customer hosting the system. This lowers key customer’s operating costs and brings other well-documented benefits of CHP including reduced transmission and distribution losses, lower emissions, and greater resiliency and reliability.

If you’re an electric utility exploring ways to get involved in CHP or get out ahead of these market changes, here’s a couple considerations to take into account:

- The benefit to utilities that build, own, and operate CHP systems may increase. Well-applied CHP can have the lowest levelized cost of energy when compared to other baseload utility resources, lower than large combined cycle projects, while also providing a wide range of additional benefits on both sides of the meter. Utilities can carefully evaluate building and owning CHP at key customer sites as a rate-based supply asset, enhancing the grid in ways that benefit all customers, while retaining key customers. Regulated utilities are not eligible for 100% first-year bonus depreciation, but the 10% ITC may be available. Utility tax considerations are complex and their potential impact must be reviewed carefully by each utility company.

- For utilities with energy efficiency programs, more customers will be able to benefit from CHP. At least 16 states allow energy savings from CHP to count toward utility energy efficiency targets. In these parts of the country, CHP represents an opportunity to improve energy efficiency portfolios with measures that capture savings from higher hanging fruit and more diverse sources. Utilities looking for new program options capable of delivering energy savings in specific locations or at certain times of day may find CHP is well-equipped to meet needs at a low-cost. Utilities already running CHP programs should talk with their customers to ensure good CHP candidates understand how the new tax laws increase the benefit of projects investments.

Long-Term Outlook

Utilities that have a strategy for collaborating with key customers on CHP are better-positioned to retain their high load factor customers while also providing greater resiliency, higher efficiency, and lower environmental impacts. Over the longer-term, these same strategies will help key customers be more competitive in their respective markets, supporting expansion, and growing the economy into the future.

Levi Hoiriis (Sterling Energy Group) contributed to this post. Sterling Energy Group is an energy engineering firm specializing in CHP, based in Atlanta, Georgia.

Note: This interpretation is based information that is currently publicly available. It is not intended as tax advice. Decisions on tax matters must be based upon advice of a tax professional and IRS documentation related to provisions of the new tax legislation, not yet available.